All Categories

Featured

2 individuals acquisition joint annuities, which supply a guaranteed earnings stream for the rest of their lives. When an annuitant passes away, the interest gained on the annuity is dealt with differently depending on the type of annuity. A type of annuity that stops all repayments upon the annuitant's death is a life-only annuity.

If an annuity's assigned beneficiary dies, the end result depends on the details terms of the annuity contract. If no such recipients are assigned or if they, as well

have passed have actually, the annuity's benefits typically advantages commonly return annuity owner's estate. If a recipient is not named for annuity benefits, the annuity proceeds commonly go to the annuitant's estate. Single premium annuities.

Single Premium Annuities death benefit tax

This can provide better control over how the annuity advantages are dispersed and can be part of an estate preparation approach to manage and safeguard assets. Shawn Plummer, CRPC Retired Life Coordinator and Insurance Representative Shawn Plummer is an accredited Retired life Planner (CRPC), insurance coverage representative, and annuity broker with over 15 years of direct experience in annuities and insurance coverage. Shawn is the owner of The Annuity Expert, an independent online insurance coverage

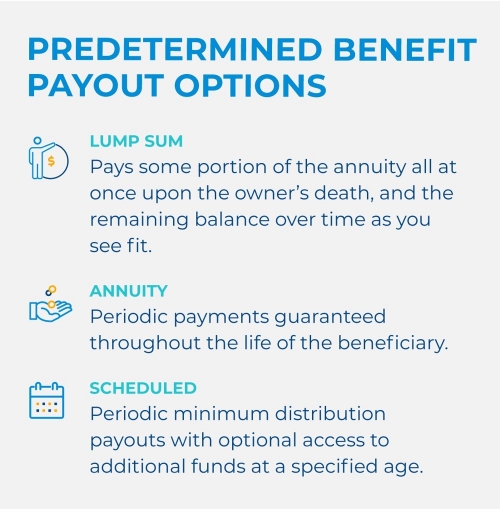

company servicing customers throughout the United States. With this platform, he and his team goal to remove the guesswork in retirement preparation by helping individuals locate the finest insurance coverage at one of the most affordable prices. Scroll to Top. I understand all of that. What I do not comprehend is how in the past getting in the 1099-R I was revealing a refund. After entering it, I currently owe taxes. It's a$10,070 difference in between the refund I was expecting and the taxes I now owe. That seems really severe. At the majority of, I would certainly have anticipated the reimbursement to lessen- not entirely go away. A monetary consultant can assist you decide just how ideal to handle an inherited annuity. What takes place to an annuity after the annuity proprietor dies depends on the terms of the annuity agreement. Some annuities just stop distributing earnings repayments when the proprietor dies. In most cases, however, the annuity has a survivor benefit. The recipient could get all the continuing to be money in the annuity or an ensured minimum payout, generally whichever is higher. If your moms and dad had an annuity, their contract will certainly define who the beneficiary is and might

right into a retired life account. An acquired individual retirement account is an unique pension used to disperse the properties of a departed person to their recipients. The account is registered in the deceased person's name, and as a beneficiary, you are incapable to make additional contributions or roll the inherited IRA over to another account. Only certified annuities can be rolledover into an acquired IRA.

Latest Posts

Understanding Financial Strategies Everything You Need to Know About Fixed Vs Variable Annuity Pros And Cons Defining the Right Financial Strategy Pros and Cons of Fixed Vs Variable Annuity Why Deferr

Understanding What Is Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Investment Choices What Is Pros And Cons Of Fixed Annuity And Variable Annuity? Pros and Cons of Various Financial Opti

Exploring Variable Annuity Vs Fixed Indexed Annuity Key Insights on Variable Annuities Vs Fixed Annuities Defining Fixed Income Annuity Vs Variable Annuity Features of Smart Investment Choices Why Fix

More

Latest Posts